Ctc For Taxes Filed In 2025

BlogCtc For Taxes Filed In 2025 - Federal Withholding Tax Table 2025 Calculator Lola Sibbie, Actc is refundable for the unused amount of your child tax credit up to $1,600 per qualifying child (tax year 2023 and 2025). The amount of your child tax credit will be reduced if your adjusted gross income exceeds $400,000 if married filing jointly or $200,000 for all other tax filing statuses. When Do Taxes Need To Be Filed By 2025 Gaye Pearle, The 2025 child tax credit can reduce your tax liability on your annual taxes. What else would change with the child tax credit?

Federal Withholding Tax Table 2025 Calculator Lola Sibbie, Actc is refundable for the unused amount of your child tax credit up to $1,600 per qualifying child (tax year 2023 and 2025). The amount of your child tax credit will be reduced if your adjusted gross income exceeds $400,000 if married filing jointly or $200,000 for all other tax filing statuses.

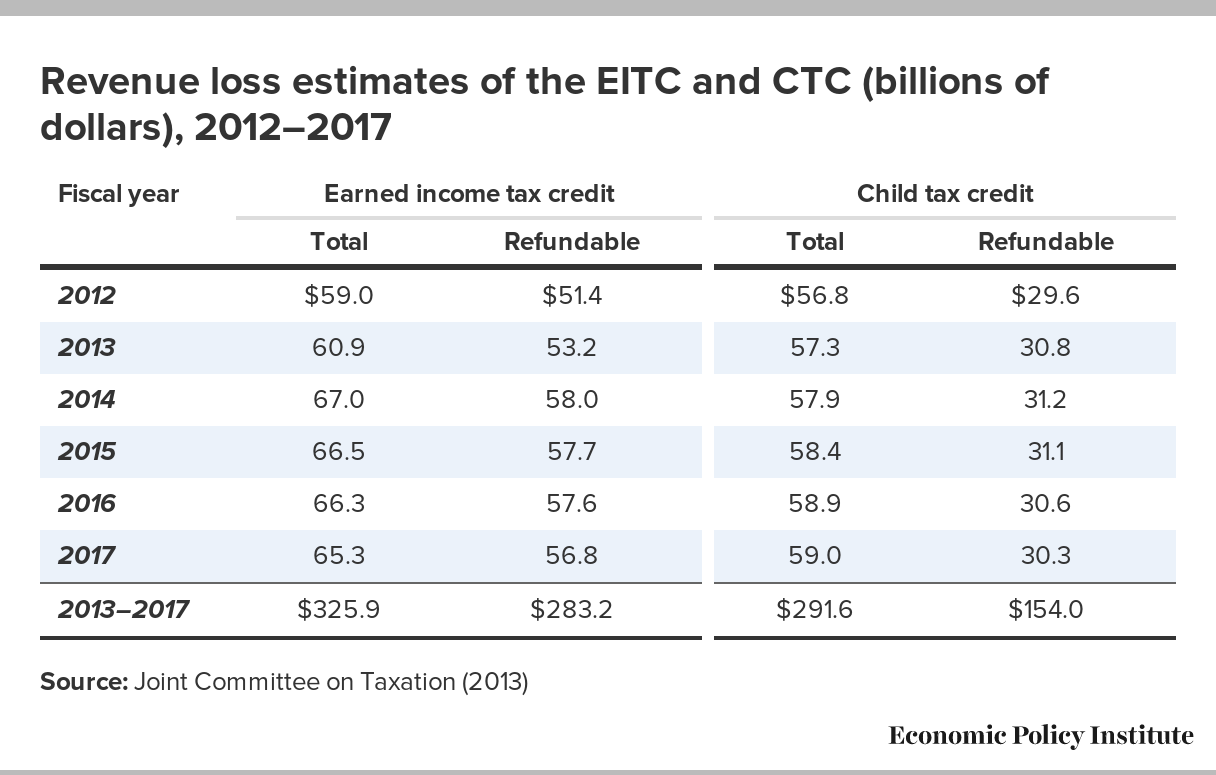

Ctc For Taxes Filed In 2025. President joe biden's budget proposal for the 2025 fiscal year calls for fully restoring the child tax credit (ctc) enacted in the american rescue plan. The ctc cut child poverty in half.

President joe biden's budget proposal for the 2025 fiscal year calls for fully restoring the child tax credit (ctc) enacted in the american rescue plan.

Irs Refund Schedule 2025 Ctc Emyle Karalynn, Who is automatically getting a monthly payment? The new deal would change the way child tax credit is calculated by allowing families to multiply the benefits per child.

How To Calculate Additional Ctc 2025 Irs Datha Cosetta, The child tax credit is a tax break families can receive if they have qualifying children. Under the proposed bill, the maximum refundable amount per child would rise to $1,800 in 2023, $1,900 in 2025 and $2,000 in 2025.

The American Families Plan Too many tax credits for children? Brookings, At the beginning of 2025, the u.s. You can claim this full amount if your income is at or below the modified adjusted gross income threshold (see the income phase out information below).

Irs Ctc Refund Dates 2025 Sonja Sisely, For the 2025 tax year (tax returns filed in 2025), the child tax credit will be worth $2,000 per qualifying child, with $1,700 being potentially refundable through the additional child tax credit. The child tax credit can significantly reduce your tax bill if you meet all seven requirements:

PPT India ctc tax calculator PowerPoint Presentation, free download, What else would change with the child tax credit? Refer examples & tax slabs for easy calculation.

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png)

Tax Calculator 2025 With Dependents Irena Saloma, The child tax credit is a tax break families can receive if they have qualifying children. Refer examples & tax slabs for easy calculation.

.jpg?width=3333&name=tax graphic_2020 (1).jpg)

When Can I File My Federal Taxes 2025 Manon Rubetta, What is the child tax credit and additional child tax credit? The increase in the credit amount, the expansion of eligibility, and the option for advance payments all aim to provide more support for parents and caregivers.

Under the provision, the maximum refundable amount per child would rise to $1,800 in 2023, $1,900 in 2025 and $2,000 in 2025.